One day, record withdrawals in the billions were observed in listed spot Bitcoin and Ethereum ETFs in the USA; investors took steps to exit the major crypto asset set during the overall market decline. However, smaller altcoin ETFs linked to Solana and XRP showed net inflows, indicating that institutional positioning might differ in volatility. According to SoSoValue data, on January 21 (ET), total net outflows in Bitcoin spot ETFs were approximately $709 million, and in Ethereum spot ETFs about $298 million, with these three days of net outflows continuing the trend.

While a total net outflow of over one billion dollars was observed in Bitcoin and Ethereum ETFs, cumulative positive flows have continued since the project inception. During this period, altcoin-like products, including Solana and XRP, also showed interesting directional shifts.

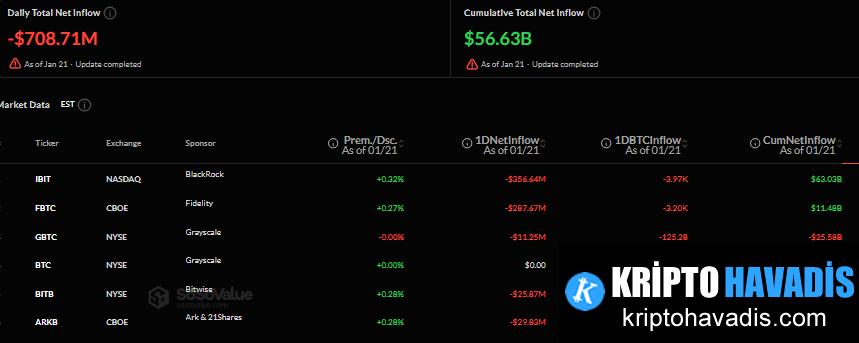

Bitcoin ETF data from SoSoValue indicates that, excluding the HODL ETF, other major Bitcoin ETFs experienced net inflows; the largest outflows occurred in iShares Bitcoin Trust (BlackRock) ({356.64} million dollars) and Fidelity’s FBTC ({287.67} million dollars). Grayscale’s GBTC, though smaller in total, recorded consistent outflows, and since conversion, has seen a total net outflow of over $25 billion.

In Bitcoin ETFs, weekly net outflows were approximately $1.19 billion; however, January remained slightly positive with net inflows of about $17.56 million. Bitcoin was trading at around $89,100 at that time, with over 7% loss in the past week; trading volume was also showing a short-term downward trend.

Pressure on Ethereum ETFs was also felt in Ethereum. On January 21, spot Ether ETFs recorded a net outflow of $297.51 million; following the heavy outflow the previous day, BlackRock’s ETHA appeared with more than $250 million in net outflows. Fidelity’s FETH and Grayscale’s ETHE also experienced net outflows; the low-fee Grayscale ETH mini trust notably recorded net inflows. ETH ETF data was obtained from SoSoValue.

Despite these outflows, Ethereum’s total asset infrastructure remained around $18.3 billion; Ethereum briefly exceeded $3,000 but then retreated again, posting a decline of approximately 13%.

Capital flows in Solana and XRP ETFs Despite selling pressure in Bitcoin and Ethereum, Solana and XRP spot ETFs attracted new capital. On January 21, net inflows in Solana ETFs were $2.92 million, bringing cumulative inflows to approximately $870 million. Asset management reached around $1.10 billion, while SOL price depreciated over 11% during the week, supported by players such as Fidelity, VanEck, and Grayscale.

XRP ETFs also recovered, recording a net inflow of $7.16 million; since launch, total net inflows reached $1.23 billion, with total assets approximately $1.39 billion. Firms like Bitwise, Franklin Templeton, and Canary Capital influenced the net flows of that day.

Note: Market observers suggest that this divergence reflects macro balanced rebalancing in Bitcoin and Ethereum ETFs, while smaller ETFs like Solana and XRP have received selective inflows following previous declines.

Anasayfa

Anasayfa Canlı Borsa

Canlı Borsa Borsa

Borsa Döviz Kurları

Döviz Kurları Altın

Altın Hisse Senetleri

Hisse Senetleri Endeksler

Endeksler Kripto Paralar

Kripto Paralar Döviz Hesaplama

Döviz Hesaplama Döviz Çevirici

Döviz Çevirici Kredi Arama

Kredi Arama